Can you be Pro-Crypto but Anti-Bitcoin?

- awilson074

- Oct 5, 2024

- 6 min read

Bitcoin, the first and most well-known cryptocurrency, has long been seen as the flagship of the crypto movement. But as the cryptocurrency space evolves, more people within the community are questioning whether Bitcoin is still the future of blockchain technology. While many may view Bitcoin as synonymous with crypto, it is becoming increasingly clear that you can be pro-crypto but anti-Bitcoin—and that this might even be the more forward-looking stance.

Bitcoin’s journey has been marked by a series of narrative shifts and contradictions that have made its original vision seem distant. Coupled with the environmental impact of its energy-intensive mining process and concerns over the mysterious entity behind its creation, more and more people are turning to other cryptocurrencies that are more scalable, energy-efficient, and practically useful. Let’s explore how Bitcoin has drifted from its revolutionary roots and why many believe its future is not as bright as other crypto projects.

The Changing Bitcoin Narrative: From Peer-to-Peer to Store of Value

When Bitcoin was first introduced in 2009, it was envisioned as a peer-to-peer digital currency that could enable decentralized financial transactions without relying on banks or governments. Satoshi Nakamoto’s original whitepaper presented Bitcoin as an alternative to fiat currencies, a way to democratize finance and allow people around the world to exchange value directly, without intermediaries.

Over the years, however, this narrative has dramatically shifted. Bitcoin is no longer marketed as a currency for daily transactions. Instead, it’s now primarily touted as a “store of value,” similar to gold. While this shift has helped Bitcoin maintain its relevance as a long-term investment, it has also limited its practical use. Bitcoin is not as scalable as other blockchains, leading to slow transactions and high fees, which make it impractical for everyday payments.

At the same time, Bitcoin has increasingly become ingrained within institutional investors. Large financial players like BlackRock, Fidelity, and Grayscale are now pushing Bitcoin as an investment for the wealthy. As the image illustrates, the combined holdings of U.S. Bitcoin ETFs (916,047 BTC) put them on track to surpass Satoshi Nakamoto’s own stash. BlackRock alone controls over 359,000 BTC, while Fidelity and Grayscale are close behind with 287,153 and 254,677 BTC, respectively. The same institutions Bitcoin was meant to disrupt are now its biggest supporters. For many in the crypto community, this embrace of institutional money represents a betrayal of the anti-establishment ethos that Bitcoin was built on. Bitcoin’s path from revolutionary tool to corporate asset has made some question its relevance in the broader crypto landscape.

However, as the crypto space evolves, it's becoming clear that there are better cryptocurrencies designed to integrate with, rather than disrupt, the traditional financial system. These cryptocurrencies offer more scalable, efficient, and forward-looking solutions, positioning themselves as the true next generation of financial technology.

The Institutional Hypocrisy

The celebration of Bitcoin’s institutional adoption is one of the most glaring contradictions in its narrative. Bitcoin’s early supporters saw it as a way to escape the control of banks, corporations, and governments. Its decentralization was supposed to put power in the hands of individuals. But today, Bitcoin is being driven by the same institutional forces it was meant to disrupt. Hedge funds, pension funds, and large investment firms now pour money into Bitcoin, and its price is largely influenced by their activity.

More troubling is the fact that Bitcoin’s mining operations are increasingly centralized. The Bitcoin network’s proof-of-work (PoW) consensus mechanism requires massive amounts of energy, and mining is now dominated by large-scale operations that have concentrated control over the network’s hash rate. This undermines the very concept of decentralization that Bitcoin was supposed to embody.

As institutional money flows into Bitcoin, it has also come under greater regulatory scrutiny. The approval of Bitcoin ETFs and the involvement of traditional financial institutions has led to a more regulated, institutionalized version of Bitcoin, far removed from its original promise of financial freedom.

Satoshi Nakamoto’s Shadow: The Mystery and the Hazard

Perhaps the most significant unknown surrounding Bitcoin is the identity of its creator, Satoshi Nakamoto. Despite Bitcoin’s massive adoption, Satoshi’s true identity remains a mystery. In fact, Homeland Security officials have reportedly met with the “four Satoshis,” but their identities have never been revealed. This mystery has only fueled speculation and concern as to what Satoshi’s ultimate intentions may have been—and more importantly, the impact they still hold over the market.

Satoshi is believed to own over 1 million Bitcoins, making them one of the wealthiest individuals—or groups—on the planet. The hazard that this represents is immense. As Bitcoin’s price skyrockets, the value of Satoshi’s holdings grows exponentially, making their influence over the market unprecedented. Should Satoshi—or whoever controls these Bitcoins—decide to liquidate their holdings, it could send the market into turmoil, crashing prices overnight.

To complicate matters, the public wallet addresses associated with Satoshi are incomplete, making it incredibly difficult to trace and track the Bitcoins they control. Despite Bitcoin’s claim of transparency through its blockchain, the invisibility of these specific holdings creates uncertainty and risk. It begs the question: if Satoshi truly wanted to step away from the project, why not destroy the Bitcoins they control rather than simply vanish? The possibility that these coins could someday flood the market continues to hang over Bitcoin like a black cloud, leading some to view it as a ticking time bomb.

The Environmental Issue: An Unavoidable Problem

Another growing concern with Bitcoin is its environmental impact. The energy-intensive proof-of-work mechanism requires vast amounts of electricity, often compared to the energy consumption of entire countries. As the world moves towards sustainability and reducing carbon footprints, Bitcoin’s energy consumption is increasingly viewed as a significant liability.

In contrast, cryptocurrencies like XRP, HBAR, XDC, and Algorand utilize more energy-efficient consensus mechanisms, such as Proof-of-Stake (PoS) and hashgraph technology. These blockchains offer faster transaction speeds, lower fees, and greater scalability, all while drastically reducing their environmental impact compared to Bitcoin’s energy-intensive Proof-of-Work (PoW) system. For those who are both pro-crypto and pro-environment, Bitcoin’s outdated PoW model is a significant limitation, pushing environmentally conscious investors and developers toward these more sustainable alternatives.

Bitcoin’s Shift to Store of Value: Limiting Its Utility

Bitcoin’s evolution from a peer-to-peer currency to a store of value has fundamentally changed how it is used and perceived. Instead of being the revolutionary digital cash Satoshi envisioned, Bitcoin is now seen more like digital gold—something to hold, rather than spend. This narrative shift has made Bitcoin less useful in the real world.

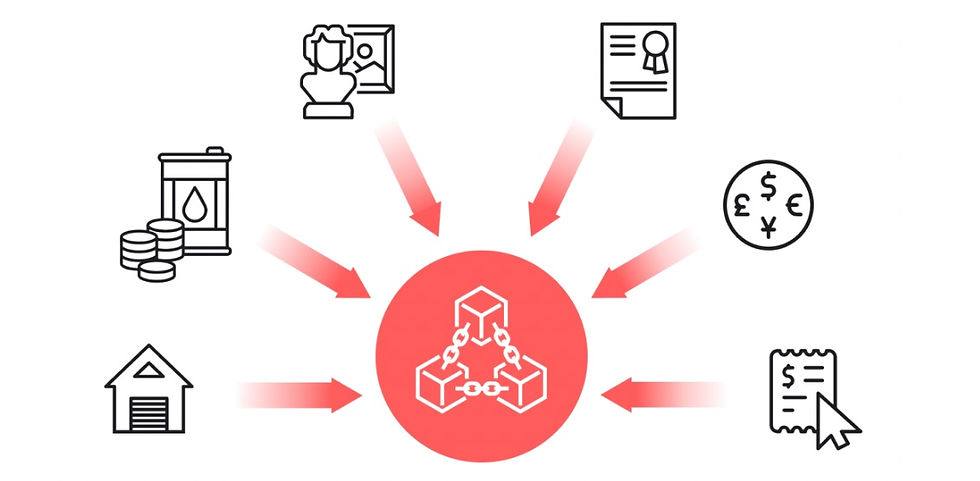

Meanwhile, other cryptocurrencies have continued to expand their utility. XRP, for example, has become a leader in cross-border payments and on-demand liquidity, working with financial institutions to create practical, real-world applications of blockchain technology. XDC is revolutionizing trade finance by enabling faster, more secure transactions between global enterprises. HBAR, with its highly efficient hashgraph technology, delivers unmatched speed and security for enterprise adoption, while Algorand is tackling financial inclusion with its fast, low-cost transactions. In short, the rest of the crypto world is moving forward, while Bitcoin is staying in place as a speculative asset.

The Path Forward

It is entirely possible to be pro-crypto but anti-Bitcoin. Bitcoin’s shifting narrative, embrace by institutional investors, environmental concerns, and the hazard of Satoshi’s hidden holdings all contribute to a growing sense that Bitcoin is no longer leading the way for blockchain innovation. Instead, projects like XRP, XDC, HBAR, and Algorand are demonstrating how blockchain can be used to solve real-world problems.

For those who believe in the decentralized future of finance, Bitcoin’s limitations are becoming more evident. While Bitcoin will likely remain a part of the crypto ecosystem for years to come, the true potential of blockchain lies in the next generation of cryptocurrencies that are more scalable, efficient, and practical.

The pro-crypto, anti-Bitcoin movement is not about rejecting the foundation that Bitcoin laid but rather acknowledging that the future of the space belongs to those projects that are building on its legacy and pushing the boundaries of what’s possible.

Flipping Bitcoin: A Matter of Time

The dominance of Bitcoin, once seen as unshakable, is now facing a challenge from more advanced, utility-driven cryptocurrencies. As the market matures, investors and institutions are increasingly drawn to projects that offer real-world solutions and greater scalability. XRP, XDC, HBAR, and Algorand are paving the way for faster, more secure transactions across industries like finance, supply chain management, and decentralized applications. Their ability to adapt and integrate with existing financial systems is positioning them to outpace Bitcoin’s limited use case as a store of value.

As adoption of these more versatile projects grows, it's only a matter of time before Bitcoin is surpassed as the number one cryptocurrency. The future belongs to networks that prioritize efficiency, utility, and scalability—qualities Bitcoin lacks. While Bitcoin’s historical importance is undeniable, its reign as the top cryptocurrency will likely come to an end as the next generation of blockchain projects rise to prominence.

Interesting perspective! I agree that it’s possible to be pro-crypto yet skeptical about Bitcoin. Many investors support blockchain innovation while questioning Bitcoin’s dominance. The bitcoin price volatility often drives people toward alternative coins and stable projects. It’s important to separate belief in crypto’s future from loyalty to a single asset.