How Tokenization Is Shaping the Future of Finance and Real Estate

- awilson074

- Jun 22, 2024

- 11 min read

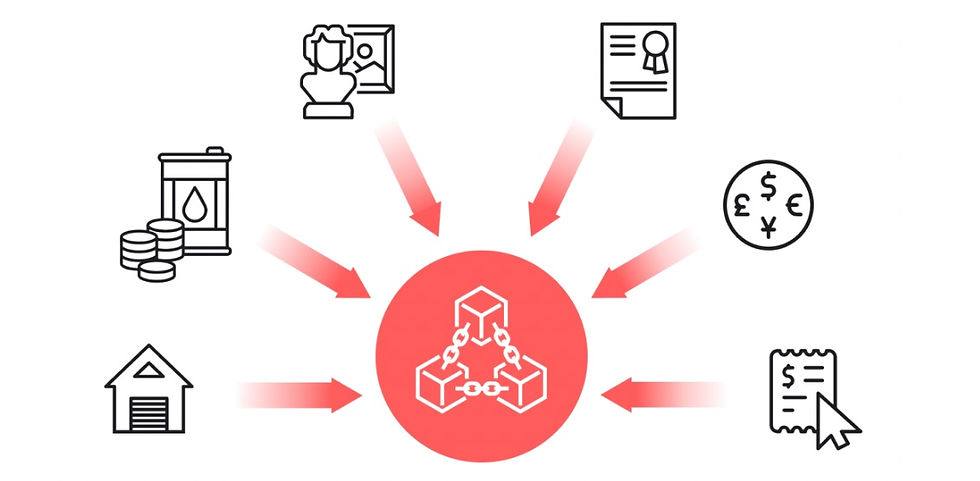

The tokenization of natural resources and assets is poised to transform the global financial system by integrating the strengths of traditional finance with the innovations of blockchain technology. The monetary system serves as the backbone of modern life, enabling the exchange of goods and services essential for daily living, such as food, shelter, and transportation.

For over a century, the monetary system has operated in a manner that benefits a privileged few at the expense of many, resulting in widespread economic inequality. Many individuals believe their national currency, such as the dollar, holds intrinsic value issued by their government. However, perceptions have evolved since the gold confiscation in 1933 and the detachment of the dollar from gold in 1971, prompting money to be backed by various assets. A new era is unfolding, reintroducing the principles of "sound money," blending the stability and trust of traditional finance with the transparency and accessibility of blockchain technology.

In traditional barter systems, parties exchange items of value, a concept that extends to modern assets like gold, silver, copper, and commodities such as coffee, cocoa beans, and oil. Tokenization facilitates the digital representation of these assets, streamlining trade with enhanced security. This fusion of traditional assets with digital tokens fosters a more inclusive and efficient financial system.

Imagine a world where individuals and nations can enter the global marketplace with digital representations of their resources. Tokenization enables the creation of asset-backed currencies, democratizing access to global trade and diminishing the monopoly of private entities over money creation. This integration establishes a fairer financial ecosystem where traditional financial systems and blockchain technology complement each other.

Tokenization also holds profound implications for sovereign debt and economic independence. Historically burdened by debt and resource exploitation, emerging market nations can leverage their natural resources to back their currencies, settle debts, and generate trade surpluses. This collaborative approach can stimulate economic growth and stability, particularly for resource-rich countries.

The convergence of traditional finance with blockchain technology offers substantial potential for global peace, elevated living standards, and the advancement of the middle class in regions like Africa. With newfound opportunities in education, infrastructure, and healthcare, nations can better cater to their populations, emancipated from historical constraints of external financial influence.

Major financial institutions such as BlackRock project that by 2030, all markets will be tokenized on blockchain, marking a historic shift. This evolution signifies a harmonious merger of traditional and modern financial systems, creating a comprehensive and robust financial ecosystem equipped to embrace new technological advancements. As individuals worldwide grasp the magnitude of this transformation, they will realize that we are living in one of the most thrilling and transformative epochs in human history.

Message to Realtors:

In the daily lives of Americans, tokenization is set to bring profound changes across various industries, including real estate. As a realtor, you are at the forefront of an exciting transformation. The process of buying, selling, and investing in properties will be revolutionized by the tokenization of assets, and this change will significantly impact your role and relationships within the industry.

Let’s talk about how properties will be tokenized. Tokenization involves creating digital tokens on a blockchain that represent ownership shares in real estate properties. Each token corresponds to a fraction of the property, and these tokens can be bought, sold, and traded much like stocks on an exchange. This means that potential buyers will no longer need to purchase an entire property to invest in real estate. Instead, they can buy tokens representing smaller shares, making real estate investment more accessible to a broader population.

As a real estate agent, your role will evolve to facilitate these transactions involving digital tokens. The traditional process of property buying and selling involves multiple intermediaries, such as brokers, banks, and legal advisors, each adding layers of complexity and cost. With tokenization, the process becomes streamlined. Blockchain technology ensures secure, transparent, and efficient transactions, reducing the need for many intermediaries and significantly lowering transaction costs. This means faster closings and less administrative work for you.

Moreover, tokenization will transform how you interact with your clients and partners. You will need to become well-versed in blockchain technology and digital assets to guide your clients through this new landscape. Education will be a crucial part of your role, helping buyers understand the benefits and mechanics of purchasing property tokens. You’ll also need to stay updated on the latest regulatory developments and ensure compliance in this evolving market.

Your relationships with traditional partners, such as banks and mortgage brokers, will change as well. These entities will need to adapt to the new tokenized environment. For instance, banks might offer new financial products tailored to tokenized real estate, such as loans against property tokens. Mortgage brokers could shift their focus to providing services that support fractional property investments. As a realtor, you’ll need to collaborate with these partners to offer comprehensive solutions to your clients.

Additionally, new partnerships will emerge with technology providers specializing in blockchain and digital tokens. These tech partners will be essential in setting up and managing the tokenization platforms, ensuring security and compliance. You’ll work closely with them to facilitate seamless transactions and provide a superior experience for your clients.

The benefits of tokenization extend beyond simplifying transactions. It also opens up new opportunities for investment and diversification. Buyers can now invest in multiple properties across different locations by purchasing tokens, reducing risk and enhancing their portfolios. This will attract a new wave of investors, including those who previously found real estate investments out of reach due to high entry costs.

For property developers, tokenization provides an innovative way to raise capital. Instead of relying solely on traditional financing methods, developers can issue tokens to investors, providing them with immediate funds to initiate and complete projects. This can accelerate development cycles and bring more properties to market.

Property management will also see changes. Token holders can collectively make decisions about the management and maintenance of the property, facilitated through smart contracts on the blockchain. These contracts can automate tasks such as rent collection, maintenance requests, and profit distribution, improving efficiency and transparency.

As you can see, tokenization is not just a trend; it’s a paradigm shift in the real estate industry. By embracing this change, you can position yourself as a forward-thinking realtor, offering innovative solutions to your clients and staying ahead of the competition. Your role will become more dynamic, involving a blend of traditional real estate expertise and cutting-edge technology.

Tokenization will bring about significant changes in the real estate industry, transforming how properties are bought, sold, and managed. As a realtor, your ability to adapt to these changes, educate your clients, and forge new partnerships will be crucial. This transformation presents a unique opportunity to enhance your services, expand your client base, and thrive in a rapidly evolving market.

Message for Financial Advisors:

The advent of tokenization represents a transformative opportunity to expand your services and offer more sophisticated, diversified investment strategies to your clients. As tokenization gains traction, your role will evolve significantly, and you’ll need to adapt to stay ahead of the curve.

Firstly, tokenization involves the creation of digital tokens on a blockchain that represent ownership shares in various assets, such as real estate, commodities, and even fine art. These tokens can be bought, sold, and traded on digital platforms, much like traditional securities. For you as a financial advisor, this means adding a new category of assets to your advisory services: digital assets.

To effectively incorporate tokenized assets into your clients’ portfolios, you will need to stay informed about the latest developments in blockchain technology and the regulatory landscape surrounding digital assets. This will require continuous learning and possibly obtaining new certifications or training in blockchain and digital finance. Understanding the nuances of tokenization and how different tokenized assets work will enable you to provide accurate and relevant advice to your clients.

The inclusion of tokenized assets in your services will lead to the creation of new financial products and investment strategies. For example, you could offer tokenized real estate funds, where clients can invest in fractional shares of high-value properties. This approach not only diversifies their portfolios but also makes real estate investment accessible to those who may not have the capital to purchase entire properties. Similarly, tokenized commodities or art funds can provide exposure to markets that were previously difficult to access for the average investor.

With tokenized assets, you can help clients build more diversified portfolios. By including a mix of traditional assets and tokenized ones, you can create investment strategies that tap into both established and emerging markets. This diversification can potentially enhance returns and reduce risks, as clients will benefit from a broader range of investment opportunities.

Your relationships with traditional partners, such as banks, mutual fund companies, and brokerage firms, will also change. These institutions are increasingly exploring blockchain technology and digital assets to stay competitive. Collaborating with them will be essential to offering comprehensive and innovative financial solutions. For instance, banks might develop new loan products using tokenized collateral, while mutual fund companies could launch tokenized index funds. By working closely with these partners, you can ensure that your clients have access to the latest financial products and services.

Additionally, new partnerships with fintech companies specializing in blockchain technology will become crucial. These tech partners can provide the platforms and tools necessary to manage and trade digital assets securely. Integrating these technologies into your practice will streamline operations, enhance transparency, and improve the client experience. You’ll work with these fintech companies to ensure seamless transactions, secure storage, and accurate tracking of tokenized assets.

Tokenization also offers the potential for greater liquidity in various asset classes. Traditional investments like real estate and fine art often suffer from illiquidity, making it difficult to buy or sell quickly. With tokenized assets, clients can trade fractions of these assets on digital exchanges, providing greater flexibility and access to liquidity. This can be particularly advantageous in volatile markets or for clients who need to quickly reallocate their investments.

Furthermore, the tokenization of assets can democratize access to investment opportunities. Historically, certain high-value assets have been accessible only to wealthy individuals or institutional investors. Tokenization breaks down these barriers, allowing a wider range of investors to participate in markets previously out of reach. This democratization can attract new clients seeking to diversify their portfolios with innovative investment options.

As a financial advisor, you will need to educate your clients about the benefits and risks of investing in tokenized assets. This will involve explaining how blockchain technology works, the security measures in place to protect digital assets, and the regulatory environment governing these investments. By providing clear and comprehensive information, you can help clients make informed decisions and build trust in this new asset class.

Tokenization is set to significantly expand the scope of services you can offer as a financial advisor. By embracing digital assets and staying informed about blockchain developments, you can create innovative financial products and investment strategies that diversify and enhance your clients’ portfolios. Your relationships with traditional and new partners will evolve, leading to more comprehensive and sophisticated financial solutions. This transformation presents an exciting opportunity to grow your practice and provide unparalleled value to your clients in an ever-evolving financial landscape.

Message to healthcare professionals:

As a healthcare professional, you are poised to witness and benefit from the significant changes that tokenization will bring to the sector. The integration of blockchain technology through tokenization is set to revolutionize how medical records are managed, how medications are tracked, and ultimately, how patient care is delivered.

Firstly, let's delve into the management of medical records. Currently, the handling of patient records involves numerous challenges, including security risks, accessibility issues, and the potential for tampering. Tokenization addresses these problems by creating digital tokens on a blockchain that represent patient records. These tokenized records are secure, tamper-proof, and easily accessible, ensuring that sensitive patient information is protected from unauthorized access and data breaches.

For you and your colleagues, this means that with a patient's consent, you can have instant access to their complete medical history. This is a game-changer for patient care. No longer will you have to rely on fragmented records from different providers or wait for lengthy transfers of information. Tokenized medical records provide a comprehensive and up-to-date view of a patient’s health history, allowing you to make informed decisions quickly and accurately. This streamlined access can lead to faster diagnoses, more personalized treatment plans, and overall improved quality of care.

From the patient’s perspective, the benefits are equally significant. They gain greater control over their own health data, with the ability to grant or revoke access to their records as needed. This empowerment of patients not only enhances their engagement in their own healthcare but also ensures that their privacy is maintained.

Moving on to the pharmaceutical industry, tokenization and blockchain technology can play a crucial role in enhancing the transparency and security of the medication supply chain. Counterfeit drugs are a persistent problem, posing serious risks to patient health and safety. By utilizing blockchain, every step of a medication's journey—from manufacturing to distribution to the pharmacy—can be tracked and recorded in a tamper-proof ledger. This ensures that the drugs reaching patients are authentic and have not been compromised at any point in the supply chain.

For you, as a healthcare provider, this means greater assurance that the medications you prescribe and administer are genuine. This transparency can significantly reduce the risk of administering counterfeit drugs, thereby safeguarding patient health. It also facilitates more efficient recalls and tracking of medication batches, ensuring that any issues can be swiftly addressed and resolved.

Moreover, tokenization can streamline the entire healthcare ecosystem by improving the efficiency of administrative processes. For example, insurance claims can be processed more quickly and accurately using smart contracts on a blockchain. These self-executing contracts automatically verify claims against tokenized records, reducing the need for manual verification and minimizing the potential for errors or fraud. This not only speeds up the reimbursement process but also reduces administrative burdens on healthcare providers.

In research and clinical trials, tokenization can enhance data integrity and collaboration. Researchers can securely share tokenized data with peers and regulatory bodies, ensuring that the information is accurate and verifiable. This can accelerate the pace of medical research and innovation, ultimately leading to new treatments and therapies reaching patients faster.

Additionally, the patient-doctor relationship stands to benefit from these advancements. With more secure and streamlined access to records and medications, trust in the healthcare system can be bolstered. Patients will feel more confident that their information is handled with the utmost care and that they are receiving authentic medications.

Tokenization is set to bring about transformative changes in the healthcare sector. As a healthcare professional, you will benefit from more secure, accessible, and tamper-proof medical records, leading to improved efficiency and quality of care. The pharmaceutical industry will see enhanced transparency and security in the medication supply chain, reducing the risk of counterfeit drugs. These advancements will not only improve patient outcomes but also streamline administrative processes and foster greater trust in the healthcare system. Embracing these changes will position you at the forefront of a more efficient, secure, and patient-centered healthcare future

Other industries improved by tokenization:

In education, tokenization can revolutionize the way academic credentials are issued and verified. Universities and other educational institutions could issue diplomas and certificates as digital tokens on a blockchain, making it easier for employers to verify qualifications and for individuals to share their achievements. This could lead to a more streamlined and reliable system for credential verification, benefiting both job seekers and employers.

Supply chain management will also be transformed by tokenization. By representing goods as digital tokens on a blockchain, companies can improve transparency and traceability throughout the supply chain. This can help in tracking the origin of products, ensuring their authenticity, and detecting fraud or theft. Consumers will benefit from knowing the provenance of the products they purchase, fostering trust in brands and products.

Tokenization will impact the entertainment industry by enabling new forms of content monetization. Musicians, artists, and other content creators can tokenize their work, allowing fans to purchase shares in their creations. This can provide creators with new revenue streams and allow fans to directly support and invest in their favorite artists. Additionally, digital tokens can facilitate the distribution of royalties, ensuring that creators are fairly compensated for their work.

The transportation sector will also benefit from tokenization. For instance, ride-sharing and car rental services can use blockchain technology to create more efficient and secure systems for booking and payment. Tokens can represent shares in vehicles, allowing for fractional ownership and more flexible use of transportation assets.

All things considered, tokenization is set to create a more integrated and dynamic financial system, combining the reliability of traditional finance with the innovation of blockchain technology. This will have far-reaching effects on daily life, reshaping industries such as real estate, finance, healthcare, education, supply chain management, entertainment, and transportation. As tokenization becomes more widespread, it promises to make financial systems more inclusive, efficient, and adaptable to the needs of a rapidly changing world.

Comments