Emotional Intelligence: Understanding and Managing Market Emotions

- awilson074

- May 29, 2024

- 6 min read

Cryptocurrency markets are known for their volatility, with dramatic price swings that can create intense emotional experiences for investors. Whether you're a seasoned trader or new to the crypto scene, understanding the emotional phases of the crypto cycle is crucial. When you're waiting for a pump that seems like it’s never coming, it’s easy to get caught in a whirlwind of emotions. However, historical data shows that these cycles are normal, and managing your emotions can help you make better decisions.

The Emotional Roller Coaster

The journey of investing in cryptocurrency often follows a predictable emotional cycle, reflecting the market's cyclical nature:

1. Optimism: As the market starts to rise, optimism and excitement fill the air. Investors feel hopeful about the future, and new money pours in.

2. Euphoria: When prices surge, euphoria sets in. It seems like the sky's the limit, and everyone is talking about the incredible returns. This phase often leads to overconfidence and riskier investments.

3. Anxiety: Prices start to level off or experience minor dips. Investors begin to worry that the bull run might be over.

4. Denial: As the market declines further, many refuse to believe that the bull run has ended. They hold onto their investments, convinced that prices will rebound soon.

5. Panic: When the market continues to fall, panic sets in. Investors scramble to sell, often at a loss, fearing even greater losses ahead.

6. Capitulation: Prices hit rock bottom, and disheartened investors give up, selling their assets and vowing never to return to crypto.

7. Despondency: This is the emotional low point. Confidence is shattered, and the market feels hopeless.

8. Hope: Gradually, prices stabilize and start to rise again. Cautious optimism returns as investors dip their toes back into the market.

9. Relief: As the market recovers, relief sets in. Investors who held on feel vindicated, and confidence begins to rebuild.

10. Optimism: The cycle begins anew as optimism returns and prices start to climb once more.

Historical Cycles

Looking back at previous market cycles, these emotional phases become apparent. For instance, during the major bull run of 2017, the market experienced incredible highs followed by a severe crash in 2018. The pattern repeated itself in 2020-2021, with a significant bull run followed by a correction. Historical data shows that while these cycles can be intense, they are part of the market's natural rhythm.

The Importance of Journaling

Keeping a journal can be an invaluable tool for managing emotions throughout these cycles. Here’s why:

1. Self-Awareness: Recording your thoughts and feelings helps you become more aware of your emotional responses to market changes. This awareness is the first step in managing emotions effectively.

2. Pattern Recognition: Over time, you'll begin to notice patterns in your behavior and the market's behavior. Recognizing these patterns can help you anticipate your emotional responses and prepare for them.

3. Decision Making: A journal allows you to reflect on past decisions and their outcomes. This reflection can provide insights into what strategies work for you and what doesn't, leading to better decision-making in the future.

4. Historical Reference: During the next market cycle, you can refer back to your journal to remind yourself of past experiences. This can be comforting and provide perspective, helping you stay calm during turbulent times.

5. Emotional Outlet: Writing down your feelings can be a healthy way to process emotions, reducing stress and anxiety.

Understanding the "Financial Innovation and Technology for the 21st Century Act”

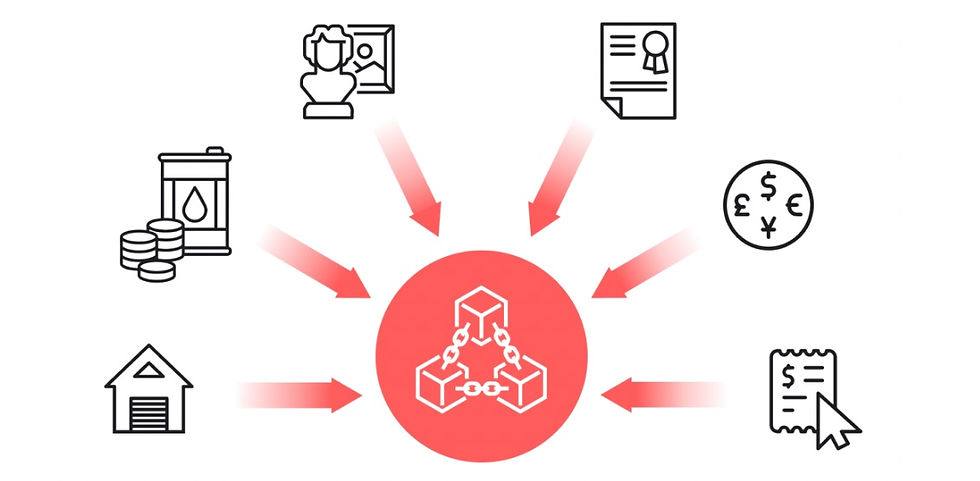

On May 22, the United States House of Representatives passed a significant bill titled the Financial Innovation and Technology for the 21st Century Act. This legislation is aimed at establishing a regulatory framework for cryptocurrencies, delineating the responsibilities between the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). The core idea is to differentiate digital assets based on the nature of their blockchain technology, which has broad implications for how these assets are regulated.

Key Provisions of the Bill

1. Regulatory Responsibilities: The CFTC would regulate digital assets as commodities if the blockchain is functional and decentralized. Conversely, the SEC would oversee digital assets as securities if the blockchain is functional but not decentralized.

2. Amendments to Existing Acts: The bill amends the Securities Exchange Act of 1934 and the Commodity Exchange Act of 1936 to divide regulatory responsibilities based on blockchain decentralization. A blockchain is classified as decentralized if no single entity controls it and no issuer or affiliated person controls 20% or more of the digital asset.

3. Exclusion from Investment Contracts: Cryptocurrencies are excluded from the definition of “investment contracts” under the Securities Act of 1933.

4. Disclosure Requirements: Developers must disclose information about the digital asset project’s operation, ownership, and structure. Exchanges, brokers, and dealers are required to provide appropriate disclosures, segregate customer funds, and reduce conflicts of interest.

Importance of the Bill

The central issue addressed by this bill is regulatory oversight. U.S. law defines securities as investment contracts, which means an investor expects profits primarily from the efforts of others. If cryptocurrencies are deemed securities, they must comply with the SEC’s stringent regulations. The SEC has traditionally viewed many cryptocurrencies as securities, while the CFTC has treated them as commodities, given their interchangeable nature.

Criticisms and Concerns

Despite the clear structure provided by the bill, it has faced criticism from certain quarters, notably from SEC Chair Gary Gensler. However, many argue that these concerns are more about maintaining power than genuine regulatory issues. Critics suggest that Gensler is fighting battles for other interests, rather than focusing on fostering innovation.

Protection Gaps: Gensler argues that excluding investment contracts on a blockchain from being classified as securities may leave investors unprotected. However, the bill aims to provide clarity and proper classification, which can foster a more robust regulatory environment.

Self-Certification Issues: While Gensler claims the self-certification process is insufficient, the bill provides a clear mechanism for contesting claims, which balances regulatory oversight and innovation.

Economic Realities vs. Technology: Gensler’s focus on economic realities over ledger technology misses the point that technological advancement should drive regulatory frameworks, not the other way around.

Regulatory Dilution: The bill does not dilute regulations but rather clarifies them, ensuring that digital assets are appropriately categorized and regulated.

Exclusion of Trading Platforms: Excluding trading platforms from SEC jurisdiction aims to foster innovation while ensuring that appropriate safeguards are in place through other regulatory bodies.

Broad Exclusions for DeFi: DeFi organizations are excluded to promote decentralization and innovation, essential for the growth of the crypto ecosystem.

New Exempt Offering Framework: The new framework is designed to encourage compliance and innovation, contrary to claims that it undermines existing exemptions.

Investor Protection Risks: The bill includes robust mechanisms to ensure that non-compliant entities cannot evade regulation, protecting investors while promoting industry growth.

Legislative Context and Future Outlook

The bill’s passage comes after Congress rejected the SEC’s Staff Accounting Bulletin-121 (SAB-121), which outlined obligations for safeguarding crypto-assets. The House passed H. J. RES. 109 to overturn the bulletin, a move criticized by the White House for potentially constraining the SEC’s regulatory capabilities. President Biden has expressed concerns about the bill’s current form, emphasizing the need for consumer and investor protections in digital asset transactions, and has shown willingness to collaborate with Congress on this issue.

The Broader Implications

This bill represents a significant shift in the regulatory landscape for cryptocurrencies. By clearly defining the roles of the CFTC and SEC based on blockchain characteristics, it aims to provide more clarity and structure to the market. As the crypto market continues to evolve, it will be crucial to monitor how these regulatory frameworks are implemented and their impact on both the industry and investors.

Final Thoughts

Navigating the emotional roller coaster of the crypto market is challenging but understanding these emotions and their place in the market cycle can help. By keeping a journal, you can gain insights into your own behavior, learn from past experiences, and develop strategies to manage emotions more effectively. Remember, patience is key. The market moves in cycles, and while the wait for a pump can be excruciating, historical data shows that the ups and downs are a normal part of the journey.

The recent legislative developments, including the Financial Innovation and Technology for the 21st Century Act, further emphasize the importance of staying informed. Understanding regulatory changes and their implications can help you navigate the market more effectively and make informed decisions. By recognizing the cyclical nature of the crypto market and the evolving regulatory landscape, you can better manage your investments and emotions, ultimately positioning yourself for long-term success in this dynamic industry. Stay informed, stay patient, and remember that Fortune Favors The Informed.

Comments