From Me to You: Time Traveler’s Chronicles of 2030 and How Cryptocurrencies Played Their Cards Right

- awilson074

- Aug 31, 2023

- 8 min read

In a twist of fate, I find myself standing in the remarkable year of 2030, where the marvels of tomorrow have become the reality of today and a testament to humanity's strides. This transformative journey has not only elevated economic equity to astonishing levels but has also eradicated the once-prevailing threat of currency weaponization, paving the way for an era marked by stability and shared prosperity for every corner of the world. This journey ignites a profound metamorphosis within the global financial framework.

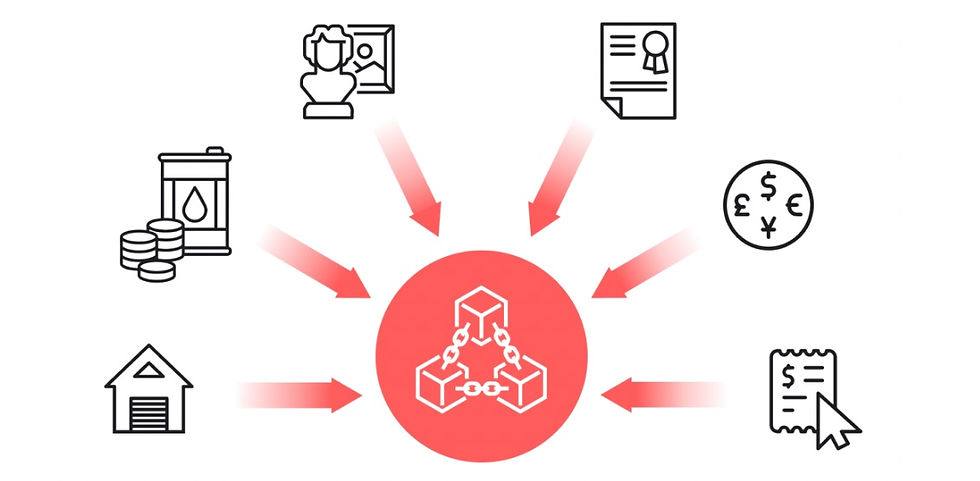

The rise of cryptocurrencies has revolutionized the concept of money, allowing for decentralized transactions on an unprecedented scale. With blockchain technology at its core, the financial landscape now operates with unprecedented transparency, security, and efficiency. Financial exclusion has become a relic of the past, as individuals around the world gain access to a borderless financial ecosystem, unshackled by traditional barriers.

One of the most remarkable outcomes of this transformation is the leveling of economic disparities. Cryptocurrencies have enabled previously underserved populations to access financial services, fostering entrepreneurship and innovation on a global scale. The unbanked now have a means to participate in the economy, as crypto wallets become digital gateways to economic empowerment. This newfound inclusivity has led to a redistribution of wealth, narrowing the gap between the privileged and the marginalized.

The elimination of intermediaries has streamlined financial processes, resulting in cost savings for businesses and individuals alike. Cross-border transactions, once burdened by excessive fees and lengthy delays, now occur seamlessly and instantaneously. This newfound efficiency has propelled international trade and cooperation to unprecedented levels, igniting a global economy that thrives on collaboration rather than competition.

The fusion of cryptocurrencies with smart contracts has given rise to a new wave of financial instruments. Smart contracts have emerged as a cornerstone of efficiency, trust, and innovation. These self-executing agreements, powered by blockchain technology, have revolutionized the way businesses, individuals, and institutions interact, streamlining processes, enhancing security, and fostering a new era of collaboration.

They’ve reshaped industries by automating complex transactions and processes, resulting in significant time and cost savings. From supply chain management to international trade, smart contracts have eliminated the need for intermediaries and manual verification, reducing the risk of errors and delays. This increased efficiency not only accelerates business operations but also frees up resources that can be redirected towards innovation and growth.

One of the most transformative aspects of smart contracts is their role in enhancing trust. Traditional contracts often rely on third parties to enforce terms and resolve disputes, which can be time-consuming and costly. Smart contracts, on the other hand, automatically execute conditions when predefined triggers are met, leaving no room for ambiguity or manipulation. This high level of transparency and immutability ensures that all parties involved can have confidence in the integrity of the agreement.

Smart contracts have also democratized access to financial services and opportunities. Through tokenization, individuals can engage in crowdfunding, lending, and other financial activities with a global reach. These decentralized platforms facilitate peer-to-peer interactions, enabling greater financial inclusion for those who were previously underserved by traditional financial institutions. The accessibility of smart contracts has the potential to level the playing field, empowering individuals to participate in economic activities on their own terms.

Moreover, the application of smart contracts extends to areas such as healthcare, intellectual property, and real estate. In healthcare, patient records can be securely stored and shared among authorized parties, ensuring privacy and efficient access to vital information. Intellectual property rights can be automatically enforced, enabling creators to receive fair compensation for their work. Real estate transactions, often laden with paperwork and intermediaries, can be streamlined through smart contracts, reducing friction and increasing transparency.

In the dynamic global economy of 2030, Central Bank Digital Currencies (CBDCs) have risen as key drivers of financial innovation, playing a pivotal role in amplifying the efficiency and reach of social programs. CBDCs, digital representations of a country's national currency issued by its central bank, have revolutionized the way governments deliver social welfare programs, ensuring greater transparency, inclusivity, and effectiveness.

The integration of CBDCs with social programs has ushered in a new era of financial inclusion. With CBDC wallets accessible to all citizens, even those without traditional bank accounts, governments are able to directly distribute funds for various social initiatives. This eliminates the need for intermediaries, streamlining the process and reducing administrative costs. Whether it's unemployment benefits, healthcare subsidies, or educational grants, CBDCs ensure that financial assistance reaches its intended recipients promptly and without discrimination.

Transparency is another hallmark of CBDC-based social programs. Every transaction conducted with CBDCs is recorded on a blockchain, providing an immutable and auditable record of fund distribution. This level of transparency minimizes the risk of fraud or misallocation, as citizens and authorities can track the movement of funds in real time. Such accountability bolsters public trust in social programs and the government's commitment to the well-being of its citizens.

The versatility of CBDCs extends to program customization. Governments can tailor the conditions and terms of social programs more efficiently using smart contracts, which are self-executing agreements on the blockchain. For instance, subsidies for specific industries can be automatically triggered when certain economic indicators reach predetermined thresholds. This flexibility ensures that social programs are responsive to evolving needs and circumstances.

CBDCs have transformed cross-border remittances, which often play a crucial role in supporting families and communities. The use of CBDCs in these transactions ensures that funds are transmitted swiftly and at a lower cost, minimizing the financial burden on those sending and receiving remittances. This global financial inclusivity enhances the well-being of not only local populations but also their extended families across international borders.

And let's not forget to mention another extraordinary transformation in the world of finance, as the tokenization of markets has reshaped the landscape of investing, empowering retail investors like never before. With the advent of blockchain technology, traditional assets such as stocks, bonds, and real estate have been digitized into tokens, unlocking a new realm of opportunities for individuals seeking to participate in these markets.

Tokenization has democratized access to a diverse array of assets, providing retail investors with unprecedented flexibility and choice. In the past, investing in real estate or purchasing bonds often required significant capital and involvement in complex processes. However, tokenization has broken down these barriers, enabling fractional ownership. Retail investors can now own a fraction of a high-value property or a corporate bond, allowing them to diversify their portfolios across previously inaccessible sectors.

Liquidity has also undergone a transformative shift due to asset tokenization. Historically illiquid markets, such as real estate, have become more liquid and accessible as tokenized assets can be traded on blockchain-powered platforms 24/7. This newfound liquidity empowers retail investors to swiftly buy or sell their holdings, responding to market conditions in real time. Additionally, tokenization has opened up secondary markets for assets that were traditionally difficult to exit, providing investors with more exit options.

The transparency and security afforded by blockchain technology have significantly enhanced trust in tokenized markets. Each transaction is recorded on an immutable ledger, minimizing the risk of fraud or manipulation. This transparency not only benefits retail investors but also instills confidence in institutional players, attracting more participants to these markets.

Furthermore, tokenization has facilitated global investing by removing geographical barriers. Retail investors can easily access international markets without the need for intermediaries, complex paperwork, or high fees. This has enabled a more diverse and globalized investment portfolio, protecting against economic downturns that may affect specific regions.

The unparalleled seamless interoperability of XRP, XDC, XLM, and HBAR has developed into the linchpin that has unlocked this new era of financial innovation and collaboration. These cryptocurrencies, operating at the intersection of cutting-edge technology and traditional systems, have successfully bridged the gap between digital assets and legacy financial infrastructure, catalyzing global economic growth and inclusion.

XRP, known for its speed and low transaction costs, has played a pivotal role in enabling rapid cross-border payments. Its interoperability capabilities have bridged the gap between different currencies, facilitating frictionless value transfer across diverse financial systems. Notably, a significant number of countries have adopted XRP as the underlying technology for their Central Bank Digital Currencies (CBDCs), utilizing the XRPL or federated sidechains to streamline international transactions. This integration with financial institutions and payment networks has further expedited global trade, reducing settlement times and enhancing cost-efficiency, ultimately catalyzing international economic growth.

XDC, the native token of the XinFin Network, has distinguished itself through its unique interoperable platform that brings together enterprises, governments, and financial institutions. This ecosystem seamlessly integrates with legacy systems, allowing for efficient cross-border trade finance, supply chain tracking, and secure payments. By enabling interoperability with traditional financial tools and processes, XDC has unlocked new avenues for businesses to operate efficiently in a globalized economy, where real-time settlement and transparency are paramount.

XLM, underpinned by the Stellar blockchain, has emerged as a beacon of financial inclusion through its interoperability-focused approach. Its decentralized exchange capabilities have seamlessly integrated with both digital and legacy assets, opening doors for individuals and institutions to transact across boundaries with minimal friction. The symbiotic relationship between XLM and traditional systems has empowered the unbanked and underserved populations by providing them access to the global financial ecosystem, fostering economic empowerment and reducing inequality.

HBAR, driven by the innovative Hedera Hashgraph platform, has redefined enterprise collaboration and DeFi through its unparalleled interoperability. With a focus on scalability and security, HBAR has seamlessly integrated with legacy systems, providing an efficient and reliable platform for businesses and developers to create robust applications. This interoperability has unlocked novel solutions across industries, from supply chain optimization to digital identity verification, seamlessly connecting the digital realm with legacy infrastructure.

To my surprise, regulatory frameworks have provided much-needed clarity to the market space. The evolving nature of these digital assets, coupled with their potential for disruption and innovation, necessitated a proactive approach by governments and regulatory bodies worldwide. Regulatory guidelines have offered the guidance required to balance technological advancement with investor protection, financial integrity, and legal compliance.

One notable aspect of the regulatory journey has been the nuanced approach taken by various countries, including the United States. While certain countries may have initially downplayed the significance of cryptocurrencies, they recognized the importance of laying a solid foundation for the industry's growth. The USA, for instance, might have had public statements that seemed dismissive of cryptocurrencies, but simultaneously, it foresaw the transformative potential and established the infrastructure for their utility over a decade ago.

The evolution of regulations has not only provided clarity to the market but also accommodated the dynamic nature of the industry. Regulatory bodies have engaged in continuous dialogue with industry players, technology experts, and legal professionals to ensure that regulations are adaptive, fostering innovation while mitigating potential risks. The result is a framework that encourages responsible innovation, protects investors, and fosters a stable ecosystem where blockchain technology and cryptocurrencies can flourish.

For those visionary individuals who believed in cryptocurrency and blockchain technology before their widespread adoption, their fortunes have been nothing short of remarkable. These early adopters recognized the transformative potential of this emerging technology and positioned themselves strategically to capitalize on its growth. As the adoption of cryptocurrency and blockchain unfolded, these early believers found themselves at the forefront of a revolution that reshaped finance, technology, and various industries. Many who invested in cryptocurrencies during their infancy experienced exponential returns on their investments.

Beyond just financial gains, the early adopters of blockchain and cryptocurrency became instrumental in shaping the trajectory of this technology. Many of them became influential figures in the tech and finance communities, advocating for the transformative potential of blockchain beyond just digital currencies. They played pivotal roles in driving research, development, and the implementation of blockchain solutions across various sectors, from supply chain management to healthcare.

The forward-thinking individuals who embraced blockchain technology early on also benefited from its application in numerous industries. Blockchain's transparency, security, and efficiency revolutionized business processes, and those who were knowledgeable in its implementation found themselves in high demand. Some early adopters even founded successful blockchain-based startups that became leaders in their respective industries.

In conclusion, standing in the remarkable year of 2030 as a time traveler, I witness a world reshaped by the fusion of technology and finance. The transformative journey that began with cryptocurrencies has led to unparalleled levels of economic equity and stability, eradicating threats that once loomed over our financial systems. This newfound era of prosperity and shared growth has redefined the very fabric of our global economy.

The rise of cryptocurrencies has proven to be a catalyst for change, reimagining the way we transact and interact in the financial realm. The decentralization of money and blockchain's transparency have driven a shift towards a more inclusive financial ecosystem, accessible to individuals worldwide. Financial exclusion is now a relic of the past, and the unbanked have found their gateway to economic empowerment. As I reflect on this remarkable journey, it's evident that the advancements of the past have laid the foundation for a future that is more connected, prosperous, and inclusive than we could have ever imagined.

Comments