Hopeful Horizons: Bills Set the Stage for Progress while Shaping the Future

- awilson074

- Jul 30, 2023

- 3 min read

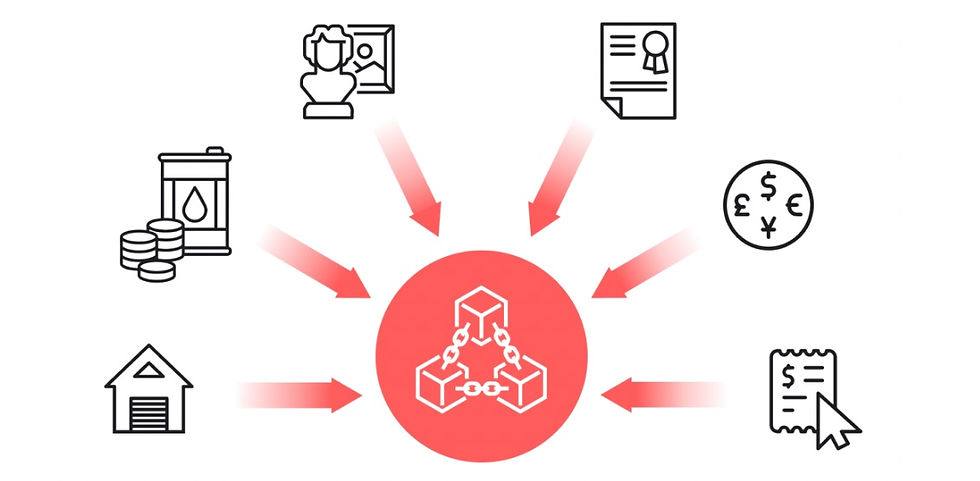

The recent passage of two crucial crypto regulatory bills by the United States House Financial Services Committee marks a significant milestone in providing the much-needed regulatory clarity to the crypto industry. These bills, the Financial Innovation and Technology for the 21st Century Act and the Blockchain Regulatory Certainty Act, are poised to play a crucial role in ensuring the thriving growth of the crypto market.

The Financial Innovation and Technology for the 21st Century Act, approved in a 35-15 vote, aims to establish clear rules for crypto firms, determining when they should register with either the Commodity Futures Trading Commission (CFTC) or the Securities and Exchange Commission (SEC). This legislation also outlines a process for firms to certify with the SEC their projects' decentralization, allowing them to register digital assets as commodities with the CFTC.

"This landmark legislation establishes robust consumer protections and clear rules of the road for market participants while keeping innovation in the United States," said Republican Congressman French Hill, vice chairman of the House Financial Services Committee, celebrating the bipartisan support for the bill.

On the other hand, the bipartisan Blockchain Regulatory Certainty Act, sponsored by Republican Congressman Tom Emmer and Democratic Congressman Darren Soto, seeks to remove obstacles and requirements for various blockchain entities, including miners, multisignature service providers, and decentralized finance platforms.

Emmer hailed the passing of this act as a "huge win" for the United States, particularly for the blockchain community. He emphasized that the act clarifies which blockchain-related entities qualify as money transmitters, thus dispelling uncertainties regarding regulatory compliance.

However, not all proposed legislation received equal support. The Digital Assets Market Structure bill faced opposition from both Republicans and Democrats. Democratic Representative Maxine Waters expressed her concerns about the bill, asserting that it closely adheres to the demands of the crypto industry and overlooks regulatory guidance from the SEC. She highlighted that existing securities laws have been instrumental in protecting investors and supporting capital formation, urging caution in creating new regulatory structures.

New York Democrat Ritchie Torres criticized the U.S. Securities and Exchange Commission (SEC) for lacking clear guidance to the crypto industry. His open letter to SEC Chairman Gary Gensler stressed the importance of adopting a more thoughtful approach to regulation and respecting legal precedents. Torres highlighted the recent ruling on SEC v. Ripple Labs, where the court declared XRP as not a security. This ruling exposed the flaws in the SEC's previous enforcement strategies and emphasized the need for a well-defined regulatory framework.

As the debate over crypto regulations continues, the House Financial Services Committee's advancement of a landmark bill that would overhaul cryptocurrency regulation is seen as a major victory for the digital asset industry. The bill, supported by bipartisan votes, aims to provide a clear framework for crypto trading by defining the roles of key regulators, the SEC, and the CFTC.

While Republicans argue that the bill fills regulatory gaps and prevents digital asset firms from relocating to countries with crypto-specific rules, Democrats criticize the process as rushed and unnecessary. Some express concerns that the bill could make it harder for the SEC to police digital asset firms.

The crypto industry views this bill's advancement as a significant step toward regulatory clarity and stability. Advocates emphasize the importance of striking a balance between regulation and innovation, fostering an environment where responsible growth can occur.

Despite the challenges and differences in opinion surrounding crypto regulation, the bipartisan support behind some bills raises hopes that the Senate will also consider the importance of creating a secure and transparent crypto market. However, skepticism remains, with some senators focusing on combating money laundering and illicit activities in the crypto space.

The debate over stablecoins also continues to be a focal point in the crypto regulatory landscape. While House Republicans hope for support from Democratic Representative Maxine Waters to pass a more-narrow crypto bill focusing on stablecoin regulation, the role of states in this process remains a contentious issue.

As discussions persist and stakeholders continue to engage, the crypto industry is looking forward to a more defined regulatory environment that promotes innovation while ensuring consumer protection and market integrity. Striking the right balance will be crucial in shaping the future of the crypto market, and stakeholders on both sides are closely watching for any breakthroughs in the ongoing discussions. As we embark on this promising journey towards comprehensive and balanced crypto regulations, we are reminded that Fortune Favors the Informed. With continued dialogue, bipartisan efforts, and a focus on innovation, we can shape a brighter and more stable future for the crypto market.

Comments