Regulatory Ripples: Assessing the SEC's Lawsuits and Gary Gensler's Role

- awilson074

- Jun 8, 2023

- 3 min read

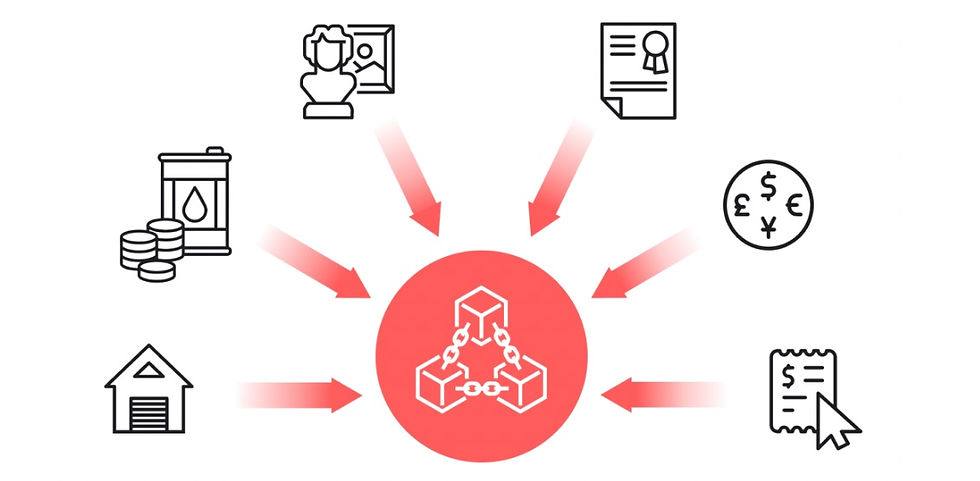

In recent developments, the Securities and Exchange Commission (SEC) has filed lawsuits against major cryptocurrency exchanges, Binance and Coinbase. While this legal battle unfolds, it has become increasingly clear that there is a dire lack of clarity surrounding digital assets. It is crucial to recognize that the SEC's authority to regulate cryptocurrencies is not explicitly granted by Congress.

It’s also important to acknowledge that the majority of tokens falling under the definition of a security, once defined by Congress and the courts, will ironically be found on the Ethereum network. This raises numerous questions, including why such tokens have been allowed to operate without regulation, potentially creating a "honey trap" that could be exploited.

In the midst of this uncertain environment, many tokens currently present in the market are unlikely to survive the regulatory scrutiny they may face. The process of legislation, litigation, and waning interest will inevitably reduce the number of available tokens. The actions against Coinbase, Binance, and Ripple (XRP) reveal the true underlying issue at hand: the SEC functions as a protection racket for a select few insiders, prioritizing the suppression of competition rather than upholding the actual law.

Brad Garlinghouse, the CEO of Ripple Labs, voiced his concerns over the SEC's overreach, stating, "It's embarrassing to watch an unelected bureaucrat flail like this to mask the fact that he and his agency don't have the power that he so desperately craves. No one is fooled." This sentiment is shared by many who believe that the SEC, under the leadership of Gary Gensler, is damaging American innovation, investors, and overall interests.

Recent revelations have shed light on potential conflicts of interest involving Gensler and Binance. Documents indicate that Gensler offered to serve as an advisor to Binance and later shared his intended testimony with Changpeng Zhao, the CEO of the exchange. Such actions raise questions about the impartiality and integrity of the SEC and its regulatory processes. However, it's important to note that firing Gensler alone may not have a significant impact, as the banking cartel could simply replace him with another paid puppet.

Amidst these developments, several key events are scheduled to take place on June 13th, 2023. Hinman emails are set to be released, shedding further light on the regulatory landscape. Additionally, the SEC must respond to Coinbase's Writ of Mandamus, adding another layer of scrutiny to their actions. The House Financial Services hearing on the Future of Digital Assets aims to provide much-needed clarity for the ecosystem. Simultaneously, the FOMC meeting and the Central Banks summer meeting will address the role of digital assets, with notable speakers from esteemed organizations such as the IMF, BIS, and BOE.

It’s crucial that we recognize the urgent need for clarity, fairness, and regulatory frameworks in the cryptocurrency industry. The lack of clear guidelines from Congress has contributed to an environment of uncertainty and limited investor protection. Instead of stifling innovation and competition, it is time to foster a collaborative approach that balances regulation with the potential of digital assets.

As the landscape evolves, it is crucial to uphold the principles of transparency, integrity, and accountability for the benefit of American innovation, investors, and overall interests. It’s past time for the American government to fulfill its responsibility to the American people and take action to curb the ease with which power grabs by the banking mafia and their henchmen occur.

Comments