🕰️The Clock is Ticking:100 Years in the Spotlight- The Rise and Fall of Global Reserve Currencies🌐

- awilson074

- Jul 6, 2023

- 3 min read

In the world of global finance, reserve currencies have historically played a pivotal role in determining commodity prices, facilitating international trade, and conducting financial transactions. For nearly a century, the US dollar has held the position of the dominant reserve currency, following in the footsteps of Spain's currency, which reigned for an impressive 110 years. However, the BRICS nations—Brazil, Russia, India, China, and South Africa—are now signaling their intent to challenge this longstanding dominance by reportedly creating a new currency backed by gold and other metals with intrinsic value.

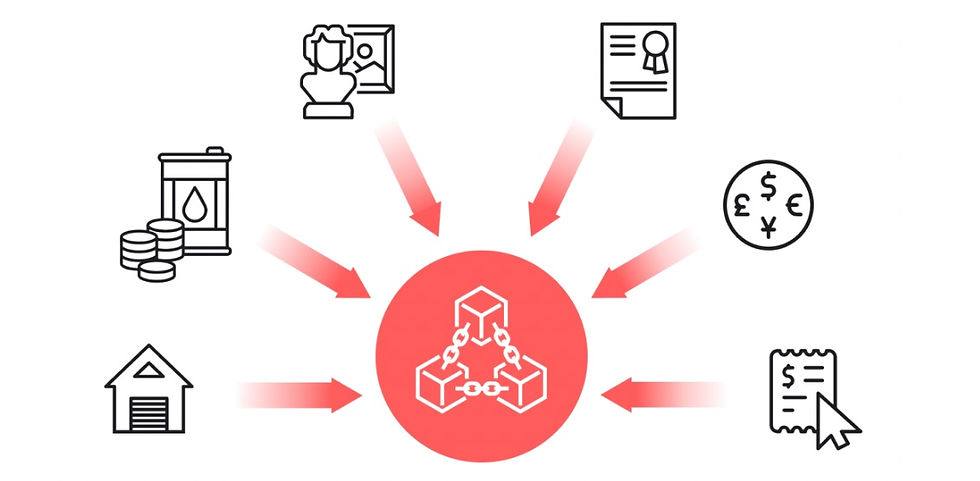

The transition from one reserve currency to another is not an overnight occurrence but rather a gradual process triggered by various factors. History has shown that excessive debt, currency devaluation, speculation, and excessive government control can erode the strength of a currency, ultimately paving the way for change. Moreover, the practice of weaponizing the financial system to exert control or impose sanctions on other countries has limitations and can lead to unforeseen consequences. The advent of blockchain technology, with its potential for greater transparency and efficiency, further threatens the effectiveness of such practices.

As the BRICS nations explore alternatives to the US dollar, attention turns to the viability of gold, silver, and other precious metals. While the transportability of these metals poses challenges in today's interconnected world, a digital currency backed by a basket of commodities, including gold, emerges as a compelling possibility. Such a currency could offer stability, security, and intrinsic value, attracting global interest and potentially reshaping the financial landscape.

In addition to their potential impact on the global financial landscape, the BRICS nations have attracted significant interest from countries around the world. Over 30 nations, both formally and informally, have expressed their desire to join the BRICS alliance, signaling the growing influence and appeal of this emerging economic bloc. Among the countries ready to align with the BRICS nations are Afghanistan, Algeria, Argentina, Bahrain, Bangladesh, Belarus, Egypt, Indonesia, Iran, Kazakhstan, Mexico, Nicaragua, Nigeria, Pakistan, Saudi Arabia, Senegal, Sudan, Syria, the United Arab Emirates, Thailand, Tunisia, Turkey, Uruguay, Venezuela, and Zimbabwe. This expanding network of nations highlights the increasing recognition of the BRICS nations' potential and their ability to shape the future of global finance and cooperation.

In January, at the World Economic Forum in Davos, Saudi Arabia's Finance Minister, Mohammed Al-Jadaan, made a momentous announcement that reverberated throughout the financial world. For the first time in 48 years, the oil-rich nation expressed its openness to trading in currencies beside the U.S. dollar. This declaration holds immense significance when considering the history of the petrodollar. Originating in the 1970s, the petrodollar system solidified the U.S. dollar's dominance by stipulating that oil sales be exclusively denominated in dollars. In return, Saudi Arabia received military protection and support from the United States. However, the potential shift away from the petrodollar marks a monumental change. It challenges the long-standing reliance on the U.S. dollar and has the potential to undermine its status as the world's primary reserve currency. Saudi Arabia's exploration of alternative currencies signals a pivotal moment in global finance and could pave the way for further diversification and transformation in the international monetary system.

The era of the US dollar as the dominant global reserve currency may be drawing to a close with

the BRICS nations creation of a gold-backed or commodity-backed digital currency. With their growing economic influence and strategic collaboration, these nations are positioning themselves to challenge the existing financial order. As we navigate this potential paradigm shift, staying informed and considering alternative options, such as precious metals and cryptocurrencies, may prove crucial in safeguarding wealth and embracing the evolving future of finance.

Comments