🕰️ Time is Money: Embracing the Long-Term in Crypto

- awilson074

- Jun 28, 2023

- 2 min read

The power of patience! Warren Buffett, often referred to as the Oracle of Omaha, is a staunch advocate of long-term investing. He emphasizes the power of patience, stating that time is the friend of a wonderful business. This philosophy resonates deeply in the crypto market, where rapid fluctuations can create anxiety and tempt investors to make impulsive decisions. Attempting to time the market is challenging, and frequent trading can lead to increased costs and emotional stress. On the other hand, a long-term approach eliminates the need for constant monitoring, aligning with Buffett's approach of disciplined decision-making.

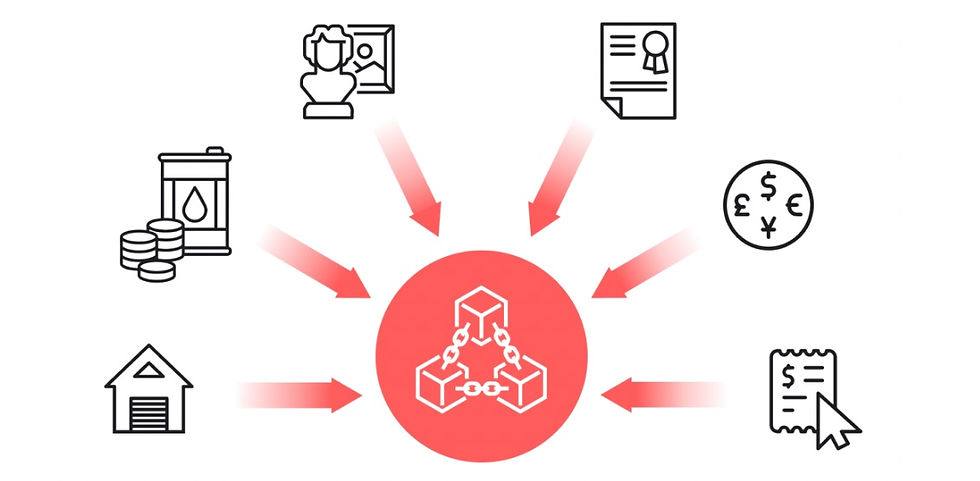

To navigate the volatile crypto market, a strategic approach that emphasizes the gradual accumulation of a diversified portfolio over time is crucial. While price fluctuations in the crypto market can be significant, it is important not to overlook the transformative potential of blockchain technology and its increasing adoption in various industries. By adopting a long-term perspective and focusing on crypto assets with practical applications, individuals position themselves to benefit from the growth and disruptive capabilities that blockchain technology offers.

On the other hand, the crypto market has experienced volatility and organized shakeouts, characterized by sudden price drops and market panic. Shakeouts aim to cause panic and create selling pressure among retail investors, enabling institutions to accumulate assets at lower prices. They often follow periods of rapid price appreciation, luring retail investors before catching them off-guard with sudden price drops. Historical examples include the stock market crash of 1929 and the Dot-Com Bubble, where FUD campaigns orchestrated significant market declines, benefiting institutions.

Applying this knowledge to the crypto market, retail investors must understand the mechanisms behind shakeouts and the tactics employed by institutions during FUD campaigns. By recognizing and mitigating the impact of fear and uncertainty, investors can make informed decisions during periods of market volatility. Thorough research, understanding cryptocurrency fundamentals, and avoiding emotional decisions are crucial. By staying informed, resilient, and adopting a long-term perspective, investors can navigate the orchestrated turbulence and capitalize on the transformative potential of the crypto market.

The crypto market requires a disciplined and patient approach. Buffett’s success is rooted in his understanding of financial history. Similarly, we can benefit from studying the historical patterns and market cycles of cryptocurrencies. By recognizing that the crypto market has experienced volatility and has shown resilience in the past, we gain perspective and confidence. Drawing lessons from history allows us to make informed decisions and navigate the market with a clearer understanding of its dynamics. By combining these approaches and staying informed, we can position ourselves for potential success in the ever-evolving crypto market.

Comments